MarketXero Footprint Pro Indicator User Guide

Order Flow Analysis with Footprint Bars

The MarketXero Footprint Pro indicator transforms traditional price bars into detailed order flow footprints, revealing the order flow dynamics that drive price movement. Unlike standard charts that only show price action (OHLC), footprint analysis displays the battle between buyers and sellers at every price level within each bar.

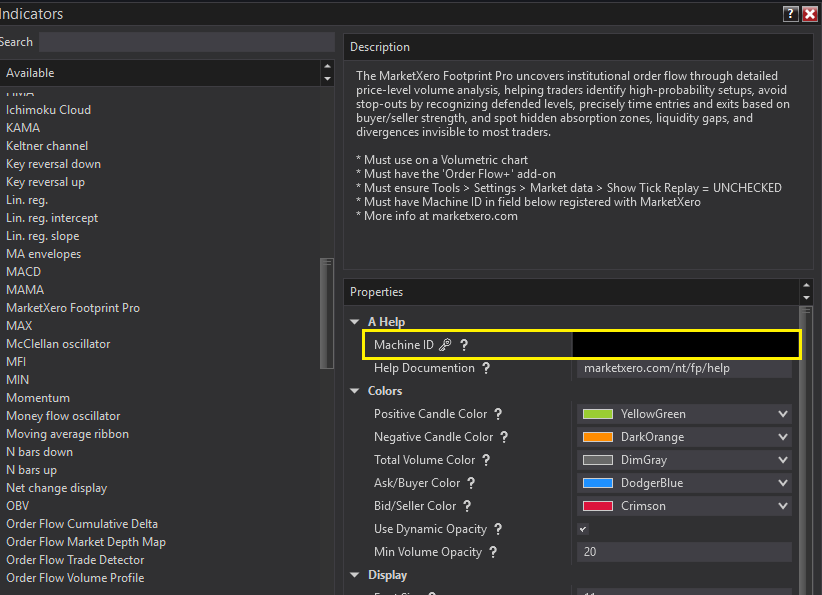

Install and Setup

Installation

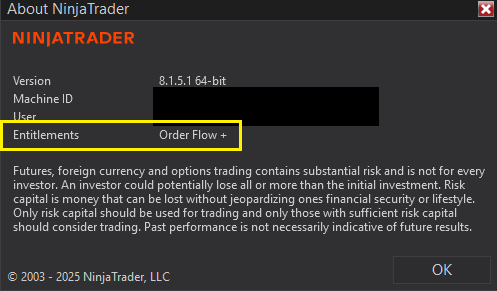

- Must have ‘Order Flow +‘ add-on from NinjaTrader

- Check: Help > About

- If missing: Tools > Client Dashboard > [logged in NT account automatically] User Settings [top-right icon] > Plans –> Plan Add-ons section

- Check: Help > About

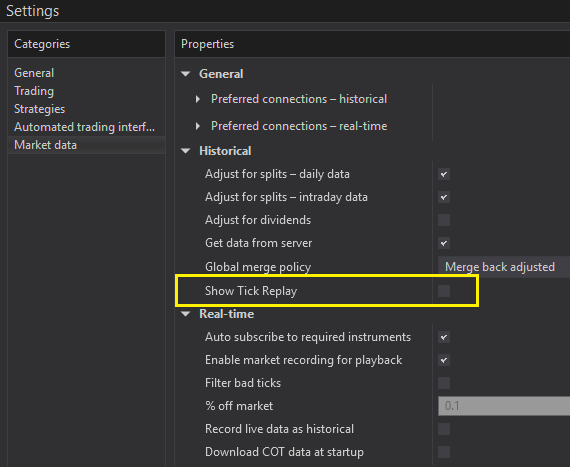

- Tick Replay must = False

- Check setting: Tools > Settings –> Market Data –> Historical –> ‘Show Tick Replay’ = False [unchecked]

- Check setting: Tools > Settings –> Market Data –> Historical –> ‘Show Tick Replay’ = False [unchecked]

- Download .zip file from the link shared in the Onboard email

- Do not extract the .zip file, leave it compressed for import into NinjaTrader

- Import .zip file indicator: Import > Add-ons

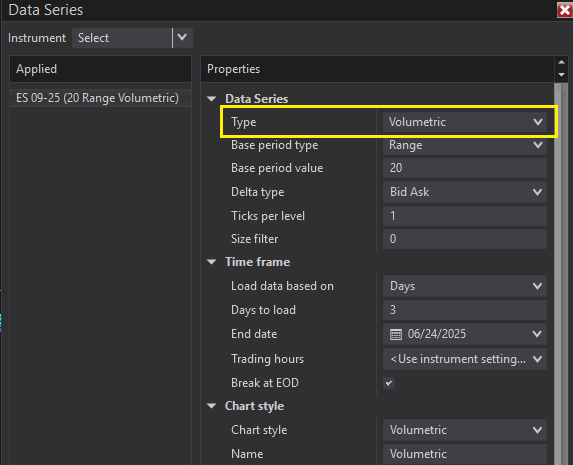

- Create chart: New > Chart

- In the Data Series dialog box: Select the instrument

- Data Series Type must = Volumetric

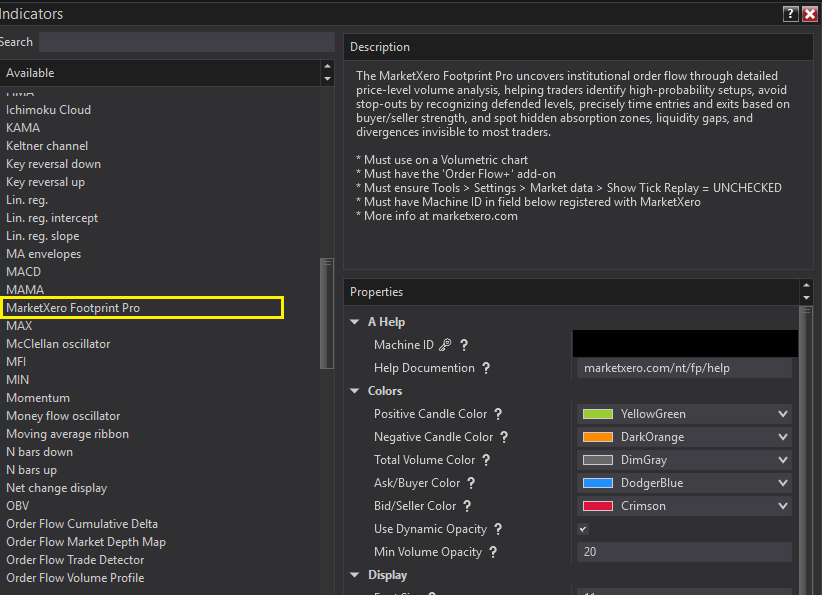

- Add MarketXero Footprint Pro indicator to your chart

- Click the Indicators icon in the chart toolbar or right-click the chart Indicators…

- Find ‘MarketXero Footprint Pro‘ from the list on the left and double click to add to the chart

- Add your Machine ID into the ‘A Help’ Machine ID form field

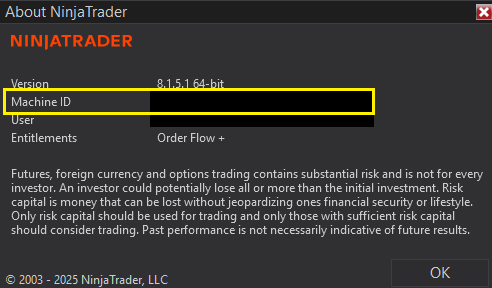

- Machine ID can be found in NinjaTrader console Help > About –> Machine ID. Copy/paste that and submit it in the form on Onboard webpage

- Activate a license for your instance of NinjaTrader by following the steps below

Licensing

- Submit your NT Machine ID on the Onboard webpage Machine ID form

- During RTH: You will get an email in 30 minutes confirming the license

- Outside of RTH: It will take longer than 30 minutes depending on day/time

- This is currently a manual process with NinjaTrader

Getting Started

- Start with default settings

- Enable Volume imbalance and Divergence/Absorption

- Gradually add features as you understand them

- Focus on one or two markets initially

- Practice on replay/simulation before live trading

Remember

Order flow analysis is a skill that develops over time. The MarketXero Footprint Pro indicator provides the tools, but successful trading requires practice, patience, and continuous learning. Focus on understanding market dynamics rather than just following signals.

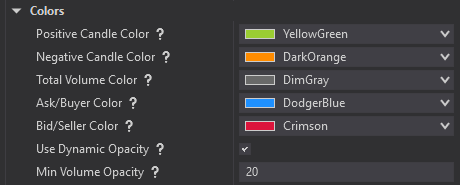

Color Section

Candle Colors

Positive Candle Color

Color for bullish candlesticks where the closing price is higher than the opening price.

Bullish Candle Characteristics

- Close > Open (price moved up during the period)

- Represents net buying pressure over the time frame

- Shows that bulls controlled the footprint outcome

- Indicates positive price momentum

Negative Candle Color

Color for bearish candlesticks where the closing price is lower than the opening price.

Bearish Candle Characteristics

- Close < Open (price moved down during the period)

- Represents net selling pressure over the time frame

- Shows that bears controlled the footprint outcome

- Indicates negative price momentum

Total Volume Color

Color for total volume bars when Display Mode is set to ‘DeltaTotal’.

- Total Volume = Bid Volume + Ask Volume combined

- Shows overall trading activity at each price level

- Represents total liquidity and interest at that price

- Used in right-column when in ‘DeltaTotal’ display mode

Ask/Buyer Color

Color for Ask volume bars representing aggressive buyers (market buy orders).

- Ask volume = Buyers hitting the ask price (aggressive buying)

- Market orders to buy that removed liquidity from sellers

- Represents bullish pressure and demand

- Shows where buyers were willing to pay the offered price

Trading Insight

- High ask volume at key levels can indicate strong buying interest and potential support

- High ask volume at key levels can also represent a short-positioned participant getting stopped out

- Stop loss (SL) orders are typically set to fill ‘at market,’ so for a short-positioned participant, this gets filled as an ‘ask order’

Bid/Seller Color

Color for Bid volume bars representing aggressive sellers (market sell orders).

- Bid volume = Sellers hitting the bid price (aggressive selling)

- Market orders to sell that removed liquidity from buyers

- Represents bearish pressure and supply

- Shows where sellers were willing to accept the bid price

Trading Insight

- High bid volume at key levels often indicates strong selling pressure and potential resistance

- High bid volume at key levels can also represent a long-positioned participant getting stopped out

- Stop loss (SL) orders are typically set to fill ‘at market,’ so for a lomg-positioned participant, this gets filled as a ‘bid order’

Dynamic Opacity Integration

Makes volume bars semi-transparent based on relative volume within each bar. The opacity (transparency) of Bid, Ask, Delta, and Total volume bars will be based on volume at each price level per footprint bar. Effective for scanning charts to find bars where volume was concentrated at specific levels. High-opacity areas can become future support or resistance.

- High Volume Levels: 100% color to highlight participant volume dominance

- Low Volume Levels: User set ‘Min Volume Opacity’ level will denote low participant volume and interest at that price level

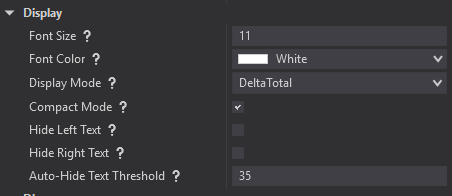

Display

Font Size

Recommended Settings

- 9-11 Best for high-resolution monitors or when zoomed out

- 12-13 Default size for most chart configurations

- 14-15 Larger text for easier reading or lower resolution

Configuration Strategy

Font Color

️Display Mode

DeltaTotal Mode

- Left Column: Delta (Ask Volume – Bid Volume)

- Right Column: Total Volume at each price

- Best for: Order flow analysis and detecting absorption patterns

BidAsk Mode

- Left Column: Bid Volume (selling pressure)

- Right Column: Ask Volume (buying pressure)

- Best for: Seeing raw buying vs selling at each price level

Compact Mode

When to Use

- Chart zoomed out showing many bars

- Smaller monitor resolutions

- Limited bar width situations

Effects

- Reduces spacing between volume bars

- Optimizes text positioning

- Makes bars appear more condensed

Hide Left/Right Column Text

Use Cases

- Chart is too zoomed out for readable text

- Reducing visual clutter while maintaining volume visualization

- Focusing on one column of data

Auto-Hide Text Threshold

Recommended Values

- 0 Never auto-hide (always show text)

- 15-25 Good for most users

- 30-50 More aggressive hiding for cleaner zoomed-out charts

How It Works

Dynamic Opacity System

Makes volume bars semi-transparent based on relative volume within each bar.

How It Works

- Highest volume level = 100% opacity (fully visible)

- Lower volume levels = Proportionally more transparent

- Minimum opacity controlled by separate setting

Benefits

- Quickly identify dominant price levels

- Reduce visual noise from low-volume areas

- Create intuitive volume visualization

- Instantly spot where most trading occurred

Trading Application

Very effective for scanning charts to find bars where volume was concentrated at specific levels. High-opacity areas often become future support or resistance.

Minimum Volume Opacity

Sets minimum transparency for low-volume bars when Dynamic Opacity is enabled.

Opacity Guidelines

- 0-20% Very transparent, dramatic effect

- 25-50% Balanced visibility (recommended)

- 60-80% Subtle transparency differences

Optimization Start with 30-40% for good balance between emphasis and visibility.

Candle Colors

Positive Candle Color = Bull bar (Close > Open)

Negative Candle Color = Bear bar (Close < Open)

Traditional Choices

- Positive: Green (bullish association)

- Negative: Red (bearish association)

AlternativeChoices

- Positive: Cyan, White (bullish association)

- Negative: Purple, Orange (bearish association)

Integration Strategy

Candle colors work with volume analysis. Bull candle with heavy ask volume confirms buying pressure, while Bull candle with heavy bid volume might indicate absorption.

Volume Colors

- Ask/Buyer Color Aggressive buyers hitting ask prices

- Bid/Seller Color Aggressive sellers hitting bid prices

- Total Volume Color Combined volume (Delta|Total mode)

Color Strategy

- Use contrasting colors for easy distinction

- Ensure readability with your font color

- Consider chart background compatibility

- Common: Green/Blue for buyers, Red/Orange for sellers

- Default: Cyan/Purple for Bull/Bear

Divergence/Absorption Analysis

Understanding Divergence/Absorption Signals

Divergence occurs when the participants controlling the candle color (overall bar direction) diverge from participants controlling the delta volume (aggressive orders).

- Absorbed Seller Positive candle despite high bid volume

- Absorbed Buyer Negative candle despite high ask volume

Absorbed Seller Signals

Occurs when aggressive sellers failed to close the candle lower than opening price.

What This Means

- Heavy selling pressure was absorbed

- Buyers defended the level successfully

- Potential bullish continuation or reversal

- Shows buyer strength at that level

Trading Applications

- Look for long opportunities

- Expect potential support at this level

- Combine with other bullish signals

- Watch for follow-through buying

Absorbed Buyer Signals

Occurs when aggressive buyers failed to close the candle higher than opening price.

What This Means

- Heavy buying pressure was absorbed

- Sellers defended the level successfully

- Potential bearish continuation or reversal

- Shows seller strength at that level

Trading Applications

- Look for short opportunities

- Expect potential resistance at this level

- Combine with other bearish signals

- Watch for follow-through selling

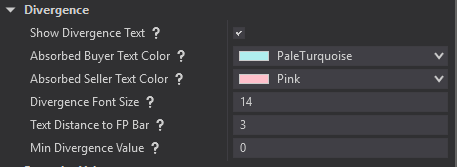

Divergence Configuration

Show Divergence Text

- Enable/disable divergence/absorption signal display.

- Recommendation Enable for divergence/absorption analysis

- Display Text appears above/below bars indicating absorption

Text Colors

- Absorbed SellerColor Text indicating seller absorption (bottom of bar)

- Absorbed Buyer Color Text indicating buyer absorption (top of bar)

- Strategy Use contrasting colors for easy identification

Font Size

Recommendations

- 8-9 Subtle, less intrusive

- 10-12 Standard size for most charts

- 14-16 Prominent, easy to spot

Text Distance

Distance from bar in ticks.

Guidelines

- 2-3 ticks Close to bar, minimal space usage

- 4-6 ticks Balanced distance

- 7+ ticks Far from bar, clear separation

Min Divergence Value

Minimum delta volume to trigger divergence.

Market Guidelines

- ES/NQ 20-30 contracts

- YM 15-25 contracts

- CL/GC 15-30 contracts

- Strategy Higher values = fewer but more significant signals

Divergence Trading Strategies

Strategy 1: Absorption Continuation

- Setup Strong absorption signal in trending market

- Logic Absorption confirms trend strength

Execution

- Identify absorption in direction of trend

- Enter pullback in trend direction

- Use absorption level as support/resistance

- Target next significant level

Strategy 2: Absorption Reversal

- Setup Absorption at key support/resistance

- Logic Shows level being defended

Execution

- Wait for absorption at significant level

- Enter in direction of absorption

- Stop beyond the tested level

- Target return to previous range

Footprint Volume

Understanding Footprint Volume

The Footprint Volume section provides advanced metrics that reveal market microstructure patterns through trade fragmentation analysis and order flow momentum tracking. These sophisticated tools help identify institutional activity, algorithmic trading patterns, and the behavior of market participants.

Positioning

These icons and volume values all work visually together, along with the Divergence/Absorption volume value, to ‘stack’ automatically on top of each other to avoid visual conflicts. The initial gap between the footprint bar and these values is determined by the ‘Text Distance to FP Bar’ in the Divergence section.

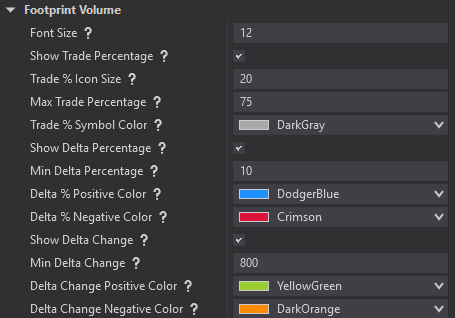

Font Size

Unified font size for all footprint volume metrics (trade percentage, delta percentage, delta change).

Show Trade Percentage

Displays trade percentage (Number of trades/contract volume × 100) above footprint bars when enabled.

Trade Percentage Concept

- Low Percentages Indicate larger average trade sizes (institutional activity)

- High Percentages Indicate more frequent smaller trades (retail/algorithmic)

Trading Applications

- Institutional Detection <75% on ES suggests participants with larger orders active on that footprint bar

- Retail Dominant >80-85% on ES indicates a stronger retail mix

Trade % Icon Size

Font size for the Trade percentage symbol icon. Does not control font size of volume values

Max Trade Percentage

Maximum trade percentage threshold for display filtering the Trade Percentage icon, and will only show the icon with values below this limit.

Trade Percentage Symbol Color

Color for Trade Percentage symbol indicator.

Show Delta Percentage

Displays delta percentage (delta/total volume × 100) above or below footprint bars based on positive/negative values.

Min Delta Percentage

Minimum absolute delta percentage required for display to filter out weak signals.

Absolute Value Filter

- Uses absolute value Both +15% and -15% trigger if minimum is 10%

- Higher Values More selective display of significant imbalances

- Lower Values Show more delta activity including moderate imbalances

Market Adaptation

- Ranging Markets Lower thresholds (5-15%) to catch subtle shifts

- Trending Markets Higher thresholds (20-40%) to filter frequent imbalances

- Volatile Sessions Increase thresholds to focus on most significant moves

- Quiet Periods Decrease thresholds to catch smaller but meaningful shifts

Market Insights

- Values >10% combined with stalled price action at a key level can indicate exhaustion of that side of the participant and a potential reversal

- Combine this with Absorption/Divergence signals to see when passive participants at key levels are absorbing exhausted participants for a stronger confluence of signals to reverse market direction

Delta Percentage Positive Color

Background color for positive delta percentage text rectangles.

Delta Percentage Negative Color

Background color for negative delta percentage text rectangles.

Show Delta Change

Displays delta change (current delta – previous delta) above or below footprint bars based on positive/negative values.

Trading Applications

- Momentum Shifts Identify acceleration or deceleration in order flow

- Divergence Analysis Spot conflicts between price and delta momentum

- Exhaustion Patterns Decreasing delta change may indicate momentum loss

- Continuation Patterns Increasing delta change suggests momentum building

Market Insights

- Large Delta Changes Often precede significant price moves

- Participant Aggression Shows shifts in market participant behavior

- Momentum Confirmation Confirms or questions price movement validity

- Trend Analysis Helps identify sustainable versus unsustainable moves

Visual Positioning

- Positive Delta Change Displayed above the bar

- Negative Delta Change Displayed below the bar

Min Delta Change

Minimum absolute delta change required for display – filters out minor order flow fluctuations.

Absolute Value Filter

- Uses absolute value Both +1000 and -1000 trigger if minimum is 500

- Higher Values More selective display of significant momentum shifts

- Lower Values Show more delta momentum changes including minor shifts

Optimization Strategy

- Volume Relationship Consider average bar volume when setting thresholds

- Session Adaptation Higher values for volatile sessions, lower for quiet periods

- Market Character Adjust based on typical delta ranges for the instrument

- Signal Quality Balance signal frequency with significance

Integration Strategy for Footprint Volume Metrics

- Trade Percentage Identifies market participant type (institutional vs retail)

- Delta Percentage Shows directional bias strength

- Delta Change Reveals momentum acceleration/deceleration

- Combined Insight Creates complete market microstructure picture

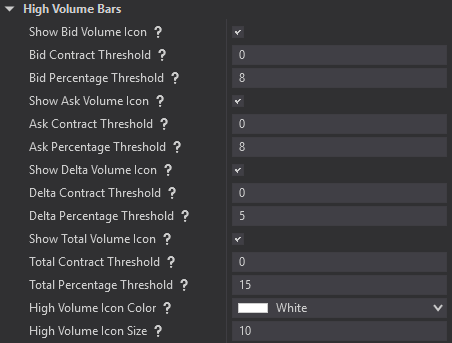

High Volume Threshold Detection

Understanding High Volume Bars

The High Volume Bars section provides sophisticated volume threshold detection using dual-criteria filtering (both contract volume and percentage thresholds). This advanced system helps identify institutional activity, significant accumulation/distribution, and exceptional market participation at specific price levels.

Dual-Threshold Logic

- Icon shows ONLY when BOTH contract AND percentage thresholds are met

- Set one of two values = 0 to ignore that mode

- Example Set Contract Threshold = 0, Percentage threshold = 10, to trigger icon based on values of 10% or greater and ignore contract values

Flexible Usage Strategies

- Contract Focus Set high contract value, low percentage

- Percentage Focus Set low contract value, high percentage

- Hybrid Approach Meaningful values for both

Show Bid Volume Icon

Displays a triangle icon on price levels where bid (seller) volume exceeds your specified threshold.

Bid Contract Threshold

Minimum bid (seller) volume contracts required at a price level to trigger the high volume icon display. Works in conjunction with Bid Percentage Threshold, BOTH must be met.

Bid Percentage Threshold

Minimum percentage of the total footprint bar volume that bid volume must represent to trigger the icon. Works with Bid Contract Threshold, BOTH must be met.

Percentage Calculation

- Formula = (Bid Volume at Price Level / Total Bar Volume) × 100

- Example 300 bid volume ÷ 1000 total volume = 30%

Show Ask Volume Icon

Displays a triangle icon on price levels where ask (buyer) volume exceeds your specified threshold.

Ask Contract Threshold

Minimum ask (buyer) volume contracts required at a price level to trigger the high volume icon display. Works in conjunction with Ask Percentage Threshold, BOTH must be met.

Ask Percentage Threshold

Minimum percentage of the total footprint bar volume that ask volume must represent to trigger the icon. Works with Ask Contract Threshold, BOTH must be met.

Percentage Analysis

- Formula (Ask Volume at Price Level / Total Bar Volume) × 100

- Example 350 ask volume ÷ 1000 total volume = 35%

- Reveals buying concentration relative to total trading activity

Optimization Approach

Set to 0% to ignore percentage and focus purely on contract volume, or combine with contract threshold for sophisticated filtering.

Show Delta Volume Icon

Displays a special icon on price levels where delta volume (Ask – Bid) exceeds your specified absolute threshold.

Strategic Insight

High delta volume often indicates strong conviction by large participants, creating important reference points for future price action.

Delta Contract Threshold

Minimum absolute delta volume (|Ask Volume – Bid Volume|) contracts required to trigger the high delta icon. Works with Delta Percentage Threshold, BOTH must be met.

Absolute Value Logic

- Uses absolute value Both +150 and -150 delta trigger if threshold is 150

- Icon shows ONLY when BOTH contract AND percentage thresholds are met

- Set to 0 to ignore contract minimum (percentage-only mode)

- Focus on extreme directional pressure regardless of direction

Delta Percentage Threshold

Minimum percentage of the total footprint bar volume that absolute delta must represent to trigger the icon. Works with Delta Contract Threshold, BOTH must be met.

Calculation Method

- Formula (|Ask Volume – Bid Volume| at Price Level / Total Bar Volume) × 100

- Example |400 ask – 100 bid| ÷ 1000 total = 30%

- Uses absolute delta value (always positive)

Show Total Volume Icon

Displays a special icon on price levels where total volume (Bid + Ask combined) exceeds your specified threshold.

Total Contract Threshold

Minimum total volume (Bid Volume + Ask Volume) contracts required at a price level to trigger the high volume icon. Works with Total Percentage Threshold, BOTH must be met.

Implementation Logic

- Icon shows ONLY when BOTH contract AND percentage thresholds are met

- Set to 0 to ignore contract minimum (percentage-only mode)

- Typically higher than individual Bid/Ask thresholds (combined volume)

- Focus on exceptional liquidity concentration

Total Percentage Threshold

Minimum percentage of the total footprint bar volume that total volume at a price level must represent to trigger the icon. Works with Total Contract Threshold, BOTH must be met.

Percentage Framework

- Formula (Total Volume at Price Level / Total Bar Volume) × 100

- Example 450 total volume ÷ 1000 total volume = 45%

- Represents concentration of all trading activity at that price

High Volume Icon Color

Color for all high volume threshold icons (Bid, Ask, Delta, and Total volume icons).

High Volume Icon Size

Font size for the high volume threshold icons displayed on exceptional volume bars.

Advanced High Volume Bar Strategies

- Contract + Percentage Most sophisticated filtering approach

- Contract Only Set percentage to 0%, focus on absolute volume

- Percentage Only Set contract to 0%, focus on relative concentration

- Market Adaptation Adjust thresholds based on typical volume patterns

Point of Control & Value Area

Understanding Point of Control

The Point of Control (POC) represents the price level with the highest volume within a footprint bar. It’s the “fair value” where most participants agreed to trade.

Why POC Matters

- Shows where most trading activity occurred

- Represents market-accepted “fair price”

- Often becomes future support/resistance

- Indicates institutional participation areas

POC Types Available

Bid POC

Price level with highest bid (seller) volume.

- Where sellers were most aggressive

- Highest concentration of selling pressure

- Potential resistance where sellers defended

Trading Applications

- Identify key selling zones for resistance

- Spot absorption when price holds above bid POCs

- Track seller commitment areas

Ask POC

Price level with highest ask (buyer) volume.

Represents

- Where buyers were most aggressive

- Highest concentration of buying pressure

- Potential support where buyers stepped in

Trading Applications

- Identify buying zones for support

- Track buyer accumulation areas

- Ask POCs often become future support levels

Delta POC

Price level with highest delta (Ask – Bid volume).

Represents

- Greatest imbalance between buyers/sellers

- Where one side overwhelmed the other

- Most significant order flow imbalance point

Trading Significance

- Positive Delta POC Buyers dominated (potential support)

- Negative Delta POC Sellers dominated (potential resistance)

- Shows where aggressive participants made their stand

Total POC

Price level with highest total volume (Bid + Ask).

Represents

- Most overall trading activity

- Combined buying and selling concentration

- Traditional “fair value” measurement

Applications

- Classic support/resistance identification

- Shows where market found most “value”

- Standard POC measurement in Market Profile

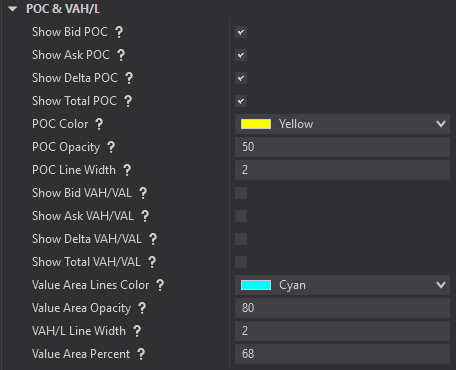

POC Configuration

POC Color

Color for POC highlight lines.

Selection Tips

- Use bright, contrasting colors (Yellow, Orange, Cyan)

- Avoid colors similar to volume bars

- Consider transparency settings

POC Opacity

Controls transparency of POC lines.

Recommendations

- 70-85% Strong visibility (recommended)

- 40-60% Balanced without overwhelming

- 90-100% Maximum prominence

POC Line Width

Thickness of POC highlight lines.

Guidelines

- 3-4 pixels Standard thickness (recommended)

- 1-2 pixels Subtle lines

- 5-6 pixels Bold, prominent lines

Value Area Analysis

Value Area represents the price range containing a specified percentage of total volume. Traditional Market Profile uses 68%.

Components

- VAH (Value Area High) Upper boundary

- VAL (Value Area Low) Lower boundary

- Volume contained Usually 68% of total volume

Value Area Types

Bid Value Area

Based on bid (seller) volume distribution.

- Shows where sellers were concentrated

- VAH can act as resistance (heavy selling area)

- VAL shows lowest prices with seller activity

- Strategy Watch for resistance at Bid VAH levels

Ask Value Area

Based on ask (buyer) volume distribution.

- Shows where buyers were concentrated

- VAL can act as support (heavy buying area)

- VAH shows highest prices with buyer activity

- Strategy Watch for support at Ask VAL levels

Delta Value Area

Based on delta volume distribution.

- Shows where strongest imbalances occurred

- Reveals battleground price levels

- Indicates aggressive participant activity

- Advanced Insight Shows where most aggressive orders were active

Total Value Area

Classic Market Profile calculation.

- Traditional support/resistance levels

- Standard “fair value” zone

- Prices outside considered “unfair

- Application Standard Value Area for traditional analysis

Value Area Configuration

Value Area Percent

Percentage of volume contained within VAH/VAL.

Standard Settings

- 68% Traditional Market Profile standard (recommended)

- 70% Slightly wider area

- 80% Much wider, less selective

- 50-60% Tighter, more selective core range

Value Area Colors & Styling

- Line Color Different from POC for clear distinction

- Opacity 60-70% recommended (slightly less than POC)

- Line Width 2-3 pixels (thinner than POC for hierarchy)

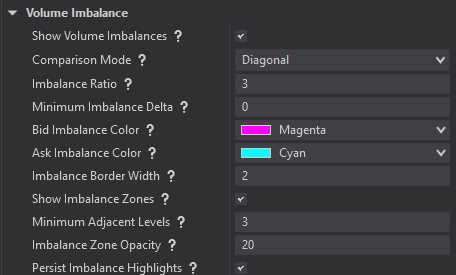

Volume Imbalance Analysis

Understanding Volume Imbalances

Volume imbalances occur when adjacent price levels show significantly different volume patterns, indicating aggressive buying or selling that “swept through” certain prices without adequate liquidity to absorb the orders.

Key Concepts

- Imbalances show where limit orders were insufficient

- Often precede continuation moves

- Reveal institutional order flow

- Create areas of future support/resistance weakness

Comparison Modes

Diagonal Comparison (Default)

Compares volume with immediately adjacent price levels.

Benefits

- Most intuitive method for traders

- Reveals traditional order flow imbalances

- Best for identifying continuation patterns

- Standard approach in most analysis

- Use For Bid/Ask Display mode

Horizontal Comparison

Compares bid vs ask volume at same price level.

Benefits

- Shows internal price level imbalances

- Reveals absorption patterns

- Better for identifying reversal patterns

- Highlights aggressor dominance

- Use For Delta/Total Display mode

Configuration Settings

Imbalance Ratio

Minimum volume ratio to trigger imbalance detection.

Examples

- 2.0 2:1 ratio (200 vs 100 volume)

- 3.0 3:1 ratio (recommended start)

- 5.0 5:1 ratio (conservative)

- 10.0 Very selective, extreme imbalances only

Minimum Imbalance Delta

Minimum volume difference required to qualify as imbalance.

Market Guidelines

- ES 20-50 contracts

- NQ 15-40 contracts

- YM 10-25 contracts

- CL 15-35 contracts

- GC 8-20 contracts

Strategy

Acts as noise filter to ensure meaningful signals

Border Colors

- Bid Imbalance Areas where selling pressure insufficient

- Ask Imbalance Areas where buying pressure insufficient

- Recommendation Use contrasting colors (Red/Blue, Orange/Cyan)

Border Width

Thickness of imbalance highlighting (1-10 pixels).

Guidelines

- 1-2 Subtle highlighting (recommended)

- 3-4 Standard thickness

- 5-6 Prominent visibility

- Note Borders drawn outward from volume bars

Imbalance Zones

Extended zones projecting forward from clusters of imbalanced price levels.

Zone Creation

- Requires minimum adjacent imbalanced levels

- Groups consecutive imbalances into zones

- Projects forward as potential targets

- Helps predict future support/resistance

Minimum Adjacent Levels

Consecutive price levels required to create zone.

Recommendations

- 2-3 Sensitive, catches smaller patterns (default)

- 4-5 Balanced approach

- 6-8 Conservative, major disruptions only

- 9+ Very selective, institutional events

Zone Opacity

Transparency of zone extensions.

Guidelines

- 20-40% Light transparency (recommended)

- 40-60% Moderate visibility

- 60-80% High visibility

- Best Practice 25-30% for visibility without overwhelming

Persistence Options

Keep historical imbalance borders visible

- Enable Preserves borders on volume imbalance touched by price

- Disable Focuses on currently active opportunities not touched by price

Note that the persist options for the volume imbalance borders will not affect the display of volume imbalance zones.

Trading Applications

Imbalance Continuation Strategy

- Setup Price approaching imbalance zone in trend direction

- Logic Imbalances often attract price for completion

- Identify imbalance zone ahead of price

- Enter as price approaches zone

- Use zone boundary as target

- Stop beyond recent swing point

Imbalance Reversal Strategy

- Setup Price reaches imbalance zone at key level

- Logic Zone completion may trigger reversal

- Wait for price to fill imbalance

- Look for reversal signals at completion

- Enter counter-trend with tight stop

- Target return to departure point

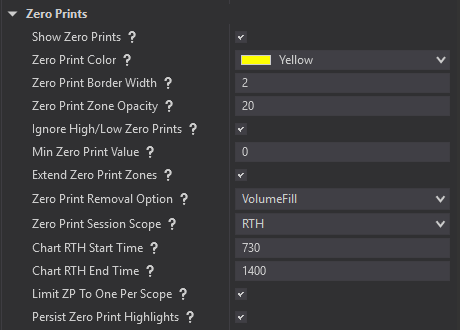

Zero Prints: Order Flow Disruption

What Are Zero Prints?

Zero prints are price levels within a footprint bar where one side of the market has absolutely zero volume. This creates a powerful signal indicating complete liquidity absence on one side.

Two Types

- Bid volume = 0, Ask volume > 0 (no sellers)

- Ask volume = 0, Bid volume > 0 (no buyers)

Why Zero Prints Matter

Zero prints reveal order flow disruptions, moments when normal auction process breaks down.

Significance

- Liquidity Gap One side completely overwhelmed

- Future Reference Price often returns to test these levels (The market hates a vacuum)

- Directional Momentum Strong pressure cleared all opposing orders

- Institutional Activity Large orders that swept available liquidity

Real-World Example

ES trading at 4850. Large institutional buy order hits all asks from 4850.25 to 4852.75. At 4851.50, no sellers offered contracts (bid volume = 0, ask volume = 150). This creates a bid zero print.

What This Reveals

- Buyers overwhelmed all sellers at 4851.50

- Level may act as support if price returns

- Break below 4851.50 could signal weakened buying pressure

Configuration Settings

Show Zero Prints

Enable zero print detection and highlighting.

- Recommendation ✓ Always enable; foundation of zero print analysis

- Visual Result Volume bars with colored borders around zero print levels

Zero Print Color

Border color for zero print highlighting.

Recommended Colors

- Magenta Unique color that rarely conflicts (default)

- Red High visibility, traditional choice

- Yellow Excellent contrast on most backgrounds

Zero Print Border Width

Thickness of zero print borders (1-10 pixels).

Guidelines

- 2-3 pixels Clean, professional appearance

- 4-5 pixels High visibility for active trading

- 6+ pixels Maximum prominence for education

Ignore High/Low Zero Prints

Excludes zero prints at bar extremes.

- Recommendation ✓ Enable (ignore edge zero prints)

- Reason Edge zero prints are often less significant – insufficient time for both sides to participate

- Zero prints will be created at new session highs and lows and only the zero prints that are created at the highest/lowest session price level will be ignored upon the footprint bar close

Min Zero Print Value

Minimum volume on non-zero side to qualify.

Market Recommendations

- ES/NQ 10-15 contracts

- YM 5-10 contracts

- CL/GC 8-12 contracts

- Strategy Higher values = fewer but more significant signals

Extended Zero Print Zones

Create visual projections forward from zero prints.

Configuration

- Zone Opacity 20-35% for visibility without overwhelming

- Removal Mode Choose “Volume Fill” vs “Price Touch”

Zone Removal Options

Volume Fill

- Zones removed only when actual volume appears

- Bid volume removes bid-side zero prints

- Ask volume removes ask-side zero prints

- Fewer false removals, zones persist longer

Price Touch

- Zones removed immediately when price touches

- No volume requirement

- More responsive, quicker removal

- Higher chance of premature removal

Session Scope Management

Regular Trading Hours (RTH)

Focus on Regular Trading Hours (primary liquidity). Configure primary session times for your market.

RTH Scope

- Focuses on primary liquidity periods

- Excludes low-volume overnight anomalies

- Best for day trading strategies

- Aligns with institutional participation

Common RTH Times

- ES/NQ/YM 930-1600 (9:30 AM – 4:00 PM ET)

- GC 930-1300 (9:30 AM – 1:00 PM ET)

- CL 930-1400 (9:30 AM – 2:00 PM ET)

- 6E 200-1600 (2:00 AM – 4:00 PM ET)

Format 24-hour time in HHMM format

Examples

- 30 = 12:30 AM

- 730 = 7:30 AM

- 1400 = 2:00 PM

- 2130 = 9:30 P

Full Session scope

Include overnight activity (important for futures)

Full Session Scope

- Includes overnight and extended hours

- Complete order flow picture

- Important for swing trading

- Captures pre/post-market activity

Limit to One Per Scope

Prevents repetitive zero print borders and zones at same price level during the user defined session scope

Persistence Settings

Control how long visual elements remain active.

- Enable Historical zero prints stay visible

- Disable Clean chart focused on current opportunities

Trading Strategies

Strategy 1: Zero Print Bounce

- Setup Price approaches previous zero print level

- Watch for support/resistance signs near zero print

- Enter away from zero print (expecting bounce)

- Stop just beyond zero print level

- Target previous swing or next significant level

- Example ES hits bid zero print at 4851.50. Go long at 4851.75, stop at 4851.25, target 4853.00

Strategy 2: Zero Print Breakout

- Setup Price breaks through zero print with volume

- Logic Break confirms the continuation of the original directional pressure

- Wait for decisive break of zero print

- Enter in direction of break

- Use zero print as new support/resistance

- Target measured moves or next level

Strategy 3: Zero Print Failure

- Setup Price fails to hold zero print support/resistance

- Logic Failure suggests original imbalance corrected

- Watch for failure to hold level

- Enter against original zero print direction

- Target return to pre-zero print levels

Common Mistakes

- Failing to set Ignore High/Low Zero Prints = true

- Over-relying on edge zero prints

- Ignoring market context (low-volume periods less reliable)

Pro Tips

- Combine with price action confirmation

- Watch for zero print clusters (stronger levels)

- Consider volume context (high-volume periods more significant)

- Use multiple timeframes (higher timeframes carry more weight)

Trading Strategies

The Triple Confirmation Setup

Divergence/Absorption + Imbalance Strategy at Key Level

Use divergence/absorption signal with volume imbalance zones at key level

Setup

- Identify divergence/absorption signal (volume text)

- Confirm with nearby imbalance zone

- Observe price hold/reject a key level

- Previous HOD/LOD

- PM HOD/LOD

- VWAP

- Enter In direction of particapants that controls price and absorbed traders on the opposite side of trade

- Stop Under supporting volume imbalance zone

- Target Front run key level or imbalance zone

- Maintain a minimum 1:2 Risk:Reward

Futures Benefits

- 24-hour trading may provide more opportunities to take profitable trades. It also provides more opportunities to lose money.

- Higher leverage can mean lower starting balances compared to equities

- Institutional participation creates clearer patterns

- Futures are not beholden to the Pattern Day Trader (PDT) rule, a regulation set by the Financial Industry Regulatory Authority (FINRA)

Critical Mistakes to Avoid

- Relying on single indicator signals

- Failing to have the patience to wait for a convergence of confirmation signals

- Forgetting to adjust for market conditions

- Over-trading low-conviction setups

- Not setting hard stops and respecting them

- R:R less than 1:2

Professional Optimization

- Backtest settings on your specific markets

- Adjust thresholds for volatile conditions

- Combine with traditional technical analysis

- Trends, VX, news, confluence of instrument pairings (ES & NQ)

- Use multiple timeframe confirmation

- Journal every trade

- Regularly review and refine settings. What worked last month may not work this month